All Categories

Featured

Table of Contents

The are entire life insurance coverage and global life insurance coverage. The money value is not included to the fatality advantage.

The plan finance passion price is 6%. Going this path, the interest he pays goes back into his policy's cash money value rather of an economic establishment.

How Can I Be My Own Bank

Nash was a financing specialist and fan of the Austrian college of business economics, which supports that the worth of products aren't explicitly the outcome of conventional economic frameworks like supply and demand. Instead, people value money and goods differently based on their financial standing and needs.

Among the risks of traditional financial, according to Nash, was high-interest prices on financings. A lot of people, himself consisted of, got into economic trouble as a result of dependence on banking establishments. So long as financial institutions set the rate of interest and car loan terms, individuals didn't have control over their own riches. Becoming your very own lender, Nash figured out, would certainly put you in control over your monetary future.

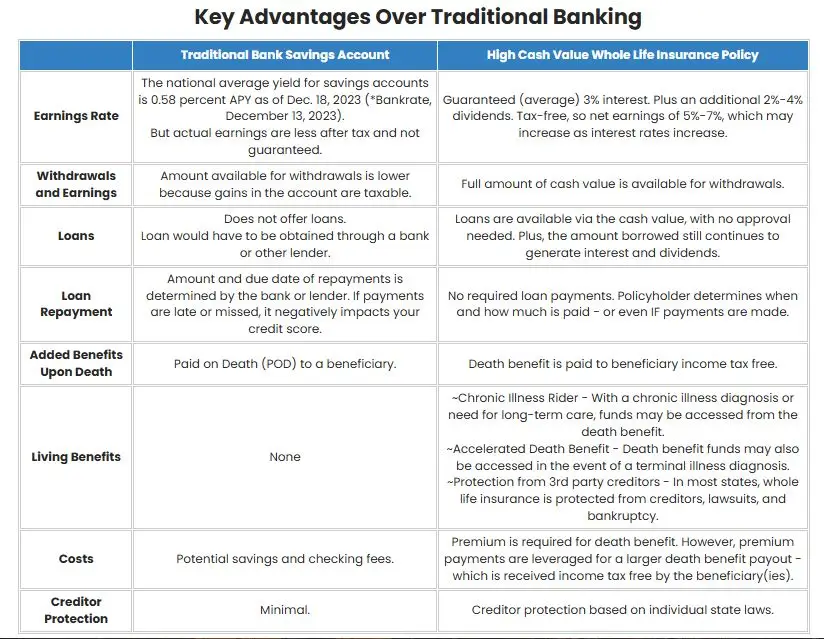

Infinite Banking requires you to have your financial future. For ambitious people, it can be the very best monetary tool ever before. Below are the benefits of Infinite Financial: Perhaps the single most helpful aspect of Infinite Banking is that it boosts your capital. You do not require to experience the hoops of a typical financial institution to obtain a loan; simply demand a plan financing from your life insurance policy company and funds will certainly be offered to you.

Dividend-paying whole life insurance policy is really low danger and supplies you, the insurance policy holder, an excellent offer of control. The control that Infinite Banking uses can best be grouped right into two categories: tax obligation advantages and possession protections.

Infinite Banking Concept Review

When you utilize entire life insurance policy for Infinite Financial, you become part of an exclusive contract in between you and your insurer. This privacy offers certain asset protections not located in various other monetary cars. Although these defenses may differ from state to state, they can include security from property searches and seizures, defense from reasonings and security from financial institutions.

Whole life insurance policies are non-correlated properties. This is why they function so well as the financial structure of Infinite Financial. Regardless of what takes place in the market (supply, real estate, or otherwise), your insurance coverage plan keeps its well worth.

Whole life insurance is that 3rd pail. Not just is the price of return on your whole life insurance policy guaranteed, your death advantage and premiums are also assured.

Below are its major advantages: Liquidity and availability: Plan lendings give prompt access to funds without the restrictions of conventional financial institution car loans. Tax performance: The money worth expands tax-deferred, and plan lendings are tax-free, making it a tax-efficient device for building riches.

Uob Privilege Banking Visa Infinite

Possession defense: In numerous states, the cash money value of life insurance policy is shielded from financial institutions, adding an added layer of financial protection. While Infinite Banking has its qualities, it isn't a one-size-fits-all solution, and it features substantial drawbacks. Below's why it may not be the ideal method: Infinite Banking commonly calls for detailed plan structuring, which can confuse insurance policy holders.

Picture never ever needing to fret concerning financial institution financings or high rates of interest once more. Suppose you could borrow money on your terms and construct riches simultaneously? That's the power of infinite banking life insurance. By leveraging the cash money value of whole life insurance policy IUL plans, you can expand your wide range and obtain money without counting on standard banks.

There's no set funding term, and you have the liberty to decide on the settlement schedule, which can be as leisurely as paying off the car loan at the time of fatality. This adaptability encompasses the servicing of the loans, where you can choose interest-only payments, keeping the finance balance level and convenient.

Holding cash in an IUL repaired account being attributed interest can typically be much better than holding the cash on down payment at a bank.: You have actually constantly desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the first expenses of renting out an area, purchasing tools, and employing staff.

Permanent Life Insurance Infinite Banking

Individual finances can be obtained from standard banks and cooperative credit union. Below are some crucial factors to think about. Credit cards can supply an adaptable way to borrow money for very short-term periods. Obtaining cash on a credit report card is normally extremely pricey with yearly portion rates of rate of interest (APR) commonly getting to 20% to 30% or more a year.

The tax obligation therapy of policy loans can differ dramatically depending upon your nation of home and the details regards to your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan lendings are normally tax-free, using a significant benefit. In other jurisdictions, there may be tax obligation implications to consider, such as possible tax obligations on the car loan.

Term life insurance just offers a death benefit, without any type of money value build-up. This indicates there's no cash money value to obtain versus.

For funding officers, the comprehensive regulations enforced by the CFPB can be seen as troublesome and limiting. Lending officers typically suggest that the CFPB's guidelines create unnecessary red tape, leading to even more documentation and slower finance handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) guideline and the Ability-to-Repay (ATR) requirements, while focused on shielding consumers, can result in delays in closing offers and boosted functional expenses.

Table of Contents

Latest Posts

Infinite Bank

Infinite Banking Software

Be Your Own Bank With Life Insurance

More

Latest Posts

Infinite Bank

Infinite Banking Software

Be Your Own Bank With Life Insurance